Green Power Pricing

Prices of green power can vary for your organization depending on multiple factors, including:

- Supply and demand variability

- Product type (e.g., renewable energy certificates (RECs), utility green power products, competitive green power products, power purchase agreements (PPAs), self-supply)

- Volume of purchase

- Term of commitment (e.g., short-term, long-term)

- Resource and technology type (e.g., solar, wind, geothermal, biomass, low-impact hydro)

- Geography (e.g., local, regional, national)

- Age of project and generation vintage

- Certification/verification status

EPA recommends seeking multiple estimates from suppliers to assess the market rate for green power products that meet your organization's goals. The following sections will review pricing information by green power product category. These pricing figures and information are illustrative and meant to provide context to the marketplace.

The green power pricing examples we are highlighting here include:

- Renewable Energy Certificates (RECs)

- Utility and Competitive Electricity Supplier Green Power Products

- Power Purchase Agreements (PPAs)

- Self-Supplied Solar

Direct price comparison between products is difficult because the product categories listed below deliver different commodities. Some product categories include:

- prices for RECs and electricity

- prices for RECs alone

- the price premium of a green power product relative to a standard electricity service

Some green power products are based on wholesale prices, typically unavailable to retail customers. For example, PPAs may include both the RECs and the electricity from a specific green power generator. In contrast, retail RECs do not include the underlying electricity.

Renewable Energy Certificates (RECs)

Retail renewable energy certificates (RECs) are sold, delivered, or purchased separately from electricity (commonly referred to as “unbundled”). They represent proof of renewable electricity delivered to the grid and represent the environmental effect or energy attributes of that renewable electricity.

RECs are a marketable commodity that are in demand with electric utilities and large and small electricity consumers (e.g., residential, commercial, and industrial), which affects market prices.

Voluntary REC Prices

Consumers can purchase RECs for their own use, enabling them to claim the use of renewable electricity exclusively. These RECS are valuable to consumers and suppliers because sales signal demand for renewable electricity beyond what would have otherwise occurred due to regulation or mandate.

Consumer buying RECs are not limited from where they buy their RECs in the U.S. and can shop for RECs with lower prices. Retail RECs are a retail product and often indicate a retail price. However, the price will be highly dependent on the volume, length of the contract, location, generation source, and date of the RECS.

Learn more about how voluntary and mandatory markets impact wholesale REC pricing.

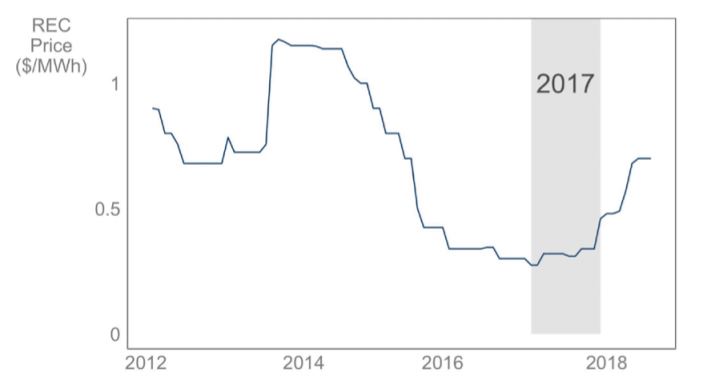

Example of Voluntary REC Prices

As depicted in Figure 3, Voluntary wholesale REC prices had been on a fairly steady decline, from $1.2/MWh in 2010 to less than $0.35/MWh in 2016 1. Recent trends have shown that REC prices in the voluntary market have increased.

Factors such as the geographic location, technology, generation date, certification, and competition with compliance-eligible RECs can also influence the price of these voluntary RECs. Most retail RECs come from wind projects, with over half coming from Kansas, Oklahoma, and Texas alone in 2015 1.

Retail RECs purchases have, and continue to be, the most popular procurement option in the voluntary green power market. Retail RECs are in high demand due to:

- Nationwide availability – They are the only nationally-available green power product, besides self-supply.

- Competitive prices – RECs are nationally available to consumers. In regional or state markets with high RPS requirements and limited supplies, RECs prices are higher.

- Customer choices – Customers can shop for RECs by resource type, location, facility age, and contract term to meet their specific needs.

- Simplicity – Purchasing Retail RECs is simpler than other green power procurement options and the transactions costs are lower.

Retail RECs purchases are a cost-premium green power option for consumers.

Compliance REC Prices

Some states have Renewable Portfolio Standards (RPS). An RPS is a legislation requiring utilities and other electric service providers to generate renewable energy themselves or purchase RECs. This type of legislation and requirements is referred to as the compliance market.

RECs that are eligible to meet state RPS compliance requirements tend to be relatively expensive than ineligible RECs. State RPS policies often create markets for eligible RECs with established procurement levels, timetables, geographic boundaries and penalize non-compliance. These factors increase the demand for RECS eligible for compliance claims by regulated entities and higher wholesale market prices.

Examples of Compliance REC Prices

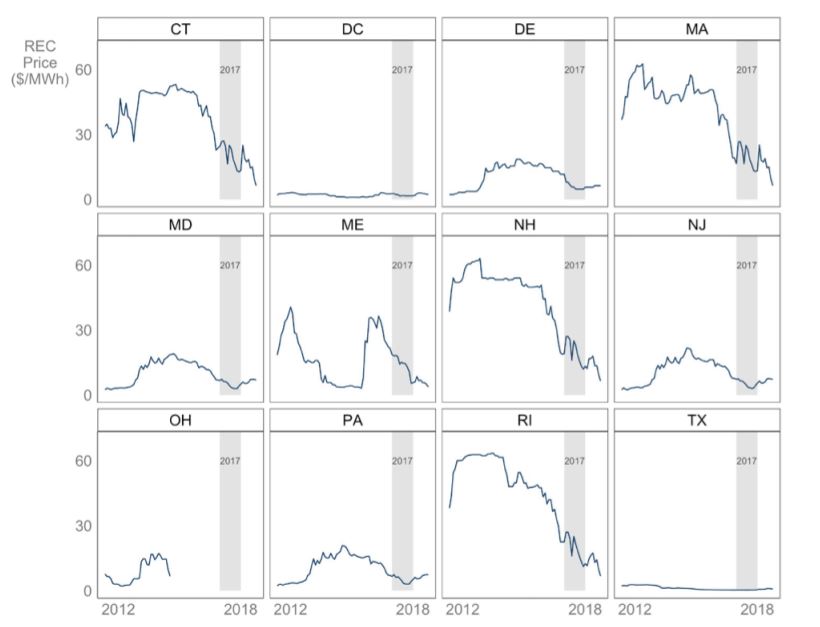

In Figure 1, wholesale prices for compliance-eligible RECs (excluding solar RECs) vary significantly by state and date. The price variation depends on that state’s specific policies and supply and demand dynamics. Compliance-eligible RECs (excluding solar RECs) have reached $60 per megawatt-hour (MWh) in some states in the last few years.

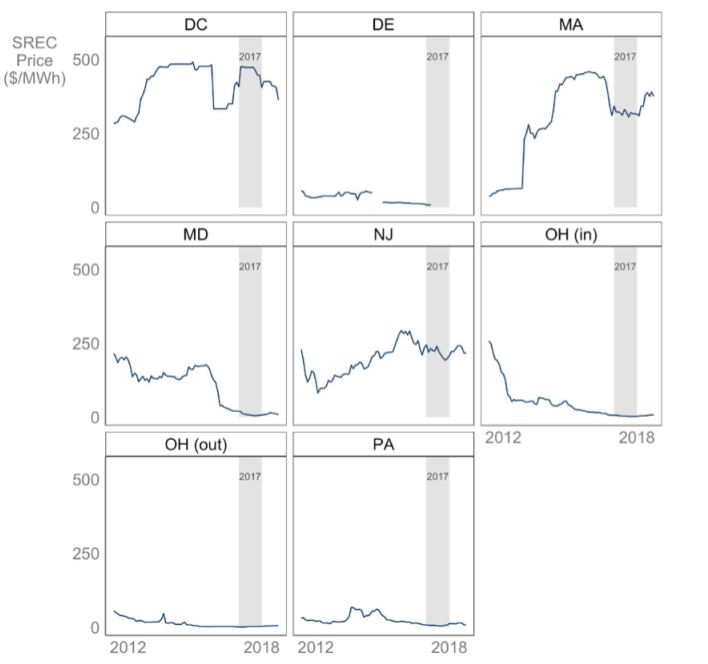

Some states have solar carve-out policies. A solar carve-out policy is a special requirement of an RPS that mandates utilities procure solar RECs (SRECs) generated in the state or pay an alternative compliance fee. States with solar carve-out policies have generally higher wholesale prices for SRECs than other compliance-eligible RECs in that state, as depicted in Figure 2.

A strong example of how state policies and design can impact the dynamics of compliance- eligible REC prices is New Jersey. In late 2011 solar installations in New Jersey surpassed the state-mandated goal of 370 MW for the Energy Year 2012 (June 1, 2011, through May 31, 2012). Once the goal was reached, demand from energy suppliers weakened, leading to an oversupply of REC. This caused the wholesale prices to decline steeply in late 2011 from about $600/MWh to $200/MWh.

Utility and Competitive Electricity Supplier Green Power Products

Many consumers gain access to renewable electricity through their electricity suppliers. In 2015, NREL estimated that nearly 790,000 electricity end-users participated in utility green power programs. 1

Utility Green Power programs are available in both traditionally regulated markets and competitive retail electricity markets.

- A traditionally regulated market is where the vertically-integrated utility is responsible for generating and delivering electricity to consumers.

- Competitive retail electricity market allows independent power producers and non-utility generators to trade power. This creates a competitive market and provides consumers with various choices to access renewable electricity.

In both of these markets, the utility-supplied green power products bundle the RECs with the electricity for the customer. In some cases, the utility may be buying retail RECs to supply their green pricing program, or they may be coming from utility-owned renewable energy projects. Participating customers usually pay a premium through an additional line item on their electric utility bill. For more information on traditionally regulated markets and competitive retail electricity markets, please visit our information on the U.S. Electric Grid.

Example of Utility and Competitive Electricity Supplier Green Power Products Prices

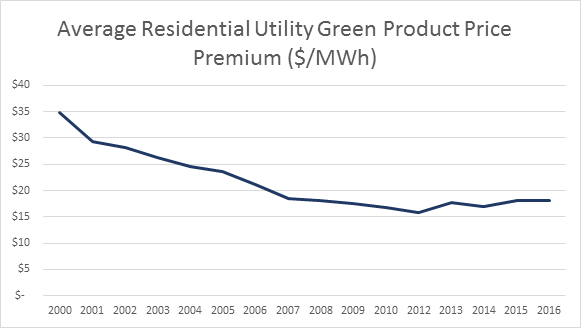

As shown in Figure 4, from 2006 through 2015, the average retail price premium over the standard offering for residential utility green power products has mainly hovered around $20/MWh or around $0.02 per kWh. This equates to an approximate $18 per month price premium for the average American home.

Retail prices for non-residential consumers are generally lower given their purchasing power. Still, average non-residential retail price premiums 2 are not available since these prices are often bi-laterally negotiated between the utility and the non-residential energy consumer.

Historically, NREL has not tracked the retail price of green power products of competitive suppliers. Hence, no data is available to demonstrate average retail prices.

Power Purchase Agreements (PPAs)

Power purchase agreements (PPAs) with off-site renewable energy generators have mainly been used by large non-residential customers who want to engage with green power projects directly. The prices in this section are illustrative and solely reflect PPAs that utilities and electricity providers have signed that bundle the sale of both electricity and RECs.

PPA pricing is highly dependent on the structure of the deal. PPAs come in two different forms, physical or financial. Physical PPAs include the physical delivery of electricity and the associated RECs from a specific green power project. Financial PPAs are a contractual agreement including delivery of RECs, but not the physical electricity produced from a project.

PPAs with institutional off-takers, such as Green Power Partners, are often financial PPAs arrangements. The project developer enters into a “contract for differences” with the off-taker around an agreed-upon strike price. These strike prices are rarely disclosed publicly, and consequently, data on PPAs with institutional off-takers is limited.

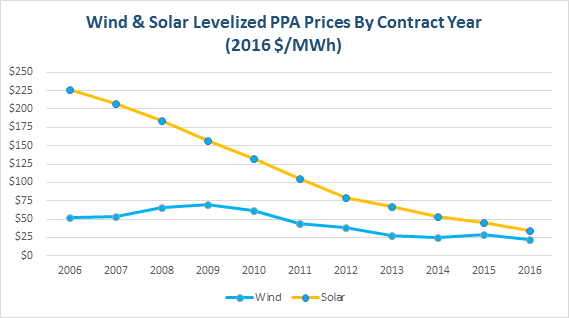

Example of PPA Price

As shown in Figure 5, the national average levelized price (levelized over the full term of each contract) of wind PPAs in the U.S. topped out at $70/MWh in 2009 and dropped to $22/MWh in 2016 2. The rise in prices through 2008 is attributed to a decline in the value of the U.S. dollar compared to the Euro; increased input prices of materials, energy, and labor; increased turbine manufacturer profitability; increased costs for turbine warranties; and an upscaling of turbine size. Wind turbine prices have decreased substantially since 2008, due to a reversal of many of these trends, increased competition among turbine manufacturers, and cost-cutting measures by component suppliers. This 20 to 40 percent price decline since 2008 has been met with significantly improved turbine technology and increasingly favorable terms for turbine purchasers, leading to even lower prices for consumers. With these lower prices, more companies are engaging with PPAs. View Clean Energy Buyers Association's Deal Tracker , which features publicly-announced PPA deals with corporate and institutional off-takers (most of which are financial PPAs).

Solar PPA prices have fallen even more drastically than wind: between 2006 and 2013, levelized PPA prices for ground-mounted solar photovoltaic arrays larger than 5 MWAC in capacity fell by an average of $20-$30/MWh annually and by $11/MWh from 2015 to 2016 to $35/MWh 3. Reasons for the steady decline in solar PPA prices since 2006 include lower installed project prices, improving capacity factors, and a decline in operation and maintenance costs. California, the Southwest, and Texas have the lowest solar PPA prices, and regions such as the Midwest are not far behind. Solar is becoming increasingly cost-competitive with other green power options such as wind.

Self-Supplied Solar

Many residential and commercial end-users choose to purchase their own solar photovoltaic (PV) systems and be responsible for its maintenance and operation. By owning their own systems, they can self-supply their own green power.

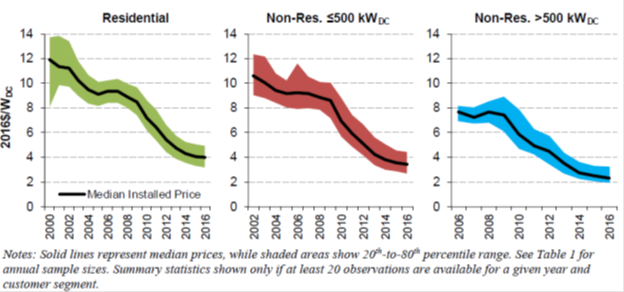

Several factors can influence installed solar PV prices, including system size (the larger the system, the lower the installed costs), installer, location (including state and local regulations), module and system type, and soft costs. Installed prices per watt for solar systems have declined significantly in the past decade, from about $9 per direct current watt (WDC) in 2006 to $4/WDC or below in 2016 4, as shown in Figure 6. These figures reflect the up-front price paid by the system owner (residential and non-residential) before receiving any incentives.

1 Source: National Renewable Energy Laboratory, Status and Trends in the U.S. Voluntary Green Power Market (2015 Data) (pdf)

2U.S. Energy Information Administration reports that the average American home uses 10,932 kWh of power annually.

3 Source: Lawrence Berkeley National Laboratory

4Lawrence Berkeley National Laboratory, Tracking the Sun 10: The Installed Price of Residential and Non-Residential Photovoltaic Systems in the United States.